Current Ratio

The Purpose of the Ratio

The current ratio evaluates a company’s ability to pay its liabilities in the near future (up to one year).

Calculation of the ratio

![]()

For the Chess Pizza example, there is $10,000 in current assets and $4,000 in current liabilities.

![]()

Significance of the Ratio

When total current assets are greater than total current liabilities, the current ratio is greater than

When total current assets are less than total current liabilities, the current ratio is less than 1.

When total current assets are equal to total current liabilities, the current ratio equals 1.

In order to thoroughly grasp the significance of the current ratio, assume that all three items included as current assets (cash, inventory and customers) of USA Furniture will be turned into cash within six months (the inventory will become furniture and be sold, and all customers will repay their full debts to the company). At the same time, the company must pay all its current liabilities within six months (payment to suppliers).

If the current ratio is greater than 1, the company will be able to pay off all of its current liabilities (payment of $4,000 to suppliers from its current assets ($10,000)).

If the current ratio is exactly 1, the slightest mishap in turning current assets into cash is liable to create difficulty in paying the company’s current liabilities.

When the current ratio is 2, the company’s managers can enjoy peace of mind.

In short, the more the current ratio exceeds 1, the more current assets exceed current liabilities and the greater the company’s ability to pay off its current liabilities (debts coming due in one year or less). A surplus of current assets in excess of current liabilities is also called positive working capital. The further a company’s current ratio is below 1, the more its current liabilities exceed its current assets, making the company less able to pay its debts in the near future.

Interpretation of the Results

The current ratios of industrial companies are usually expected to be between 1 and 2. A current ratio slightly below 1 is still no reason for a company to declare “bankruptcy.” If the ratio is significantly lower than 1 (0.5 or lower), however, it should serve as a warning about the company’s ability to make payments in the near future.

When the current ratio is very high (3 or greater), it means that the company is easily able to repay its debts in the near future. On the other hand, it may also indicate a lack of efficiency in the company, and that it holds too many current assets (particularly if the cash assets or numbers of inventory items are substantial), which should instead be invested in more profitable instruments.

Quick Ratio

Purpose of the Ratio

The quick ratio is similar to the current ratio. It is designed to evaluate a company’s ability to pay its current liabilities under a particularly restrictive assumption that its inventory cannot be turned into cash during the current year for purposes of paying debts coming due.

Calculation of the ratio

![]()

For the Chess Pizza example there is $10,000 in current assets, $4,000 in inventory and $4,000 in current liabilities.

![]()

Significance of the Ratio

When the quick ratio is equal to 1, as in the case of USA Furniture, this indicates that the company is able to pay off all of its current liabilities using assets that it can immediately turn into cash (in this case, cash in the bank and credit to customers) without having to sell its inventory.

Interpretation of the Results

The quick ratios of industrial companies are usually expected to be around or slightly lower than 1. If the ratio is significantly lower than 1 (0.4 or lower), it should serve as a warning about the company’s ability to make payments in the near future.

As with the current ratio, when the quick ratio is too high (2 or greater), this indicates that the company has too many liquid assets and should perhaps divert some of them to more profitable instruments.

Financial Leverage Ratio

Purpose of the Ratio

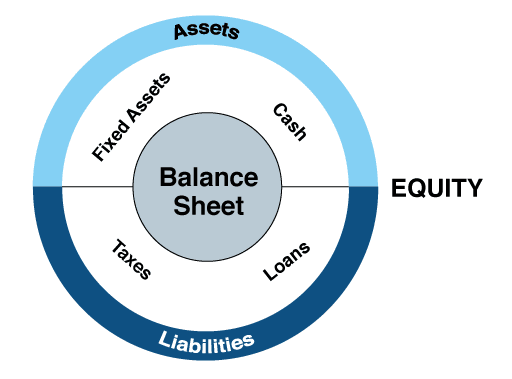

The financial leverage ratio evaluates the company’s debt burden as a fraction of the firm's total assets.

Calculation of the ratio

This ratio is usually calculated in percentages, which is why the results are multiplied by 100.

![]()

For the Chess Pizza example, there is $30,000 in total assets and $20,000 in equity.

![]()

Significance of the Ratio

This ratio measures the degree to which a company relies on its internal resources (equity), and the degree to which it relies on external sources (liabilities) in order to finance its activities.

For example, if the ratio is 200%, this means that the company’s equity has been leveraged once over so that the firm now manages two times the owner's investment in assets.

In accounting, when a company relies too much on external sources to finance its activity, it is usually said to have too great a degree of “financial leverage.”

Interpretation of the Results

Too much leverage can be risky for a company. A very high number for financial leverage means that the company owes a lot of money to lenders, suppliers and other stakeholders.

On the other hand, a very low number for financial leverage means that the firm is not utilizing credit. It might not be exploiting the owner's equity efficiently and may be letting opportunities slip by that it could seize by using credit.

It should be noted that financial leverage should be considered relative to an organization's peers, and should not be compared across different industries. For example, a bank or other financial company will typically have more leverage than a manufacturer. For most businesses, a financial leverage that is greater than 2 is considered high. For real estate and financial services companies, leverage ratios are commonly higher. In contrast, many technology companies have financial leverage near a value of 1.

Debt-to-Equity Ratio

Purpose of the Ratio

This ratio compares the portion of a company that is financed by liabilities to the rest that is paid for by owner's equity.

Calculation of the ratio

This ratio is either calculated as a decimal or is reported in percentages by multiplying the result by 100%.

![]()

For the Chess Pizza example, there is $10,000 in total liabilities and $20,000 in equity.

![]()

Significance of the Ratio

The debt-to-equity ratio is another way to measure the degree to which a company relies on its internal resources (equity), and the degree to which it relies on external sources (liabilities) in order to finance its activities. It is another way to convey the information presented by the financial leverage ratio.

Interpretation of the Results

Using ownership to pay for assets is much safer than using debt, credit and other liabilities to finance assets. Borrowing from suppliers, banks and customers is only a temporary source of funding, since they expect to be paid back or made whole in the future.

Stakeholders know that using liabilities to pay for assets leads to more risk. Many investors demand that companies should be financed more by equity than debt, which means that they will only invest in companies with debt-to-equity ratios below 1. However, using a single number as a target or maximum for the debt-to-equity ratio makes very little sense.

Instead, debt-to-equity ratios should be considered relative to an organization's peers in the same industry. For example, a bank, other financial company or a real estate company will typically have more leverage than a manufacturer. Many technology companies have almost no liabilities and often have debt-to-equity ratios near zero.

[dropshadow type=”annuity_rate”] [/dropshadow]

[/dropshadow]