Make it Count

When you make a plan, you need to be careful and use every advantage you can get. You have abilities and experience already that will help you plan effectively, and you need to walk the line between your desires and what you believe is really possible.

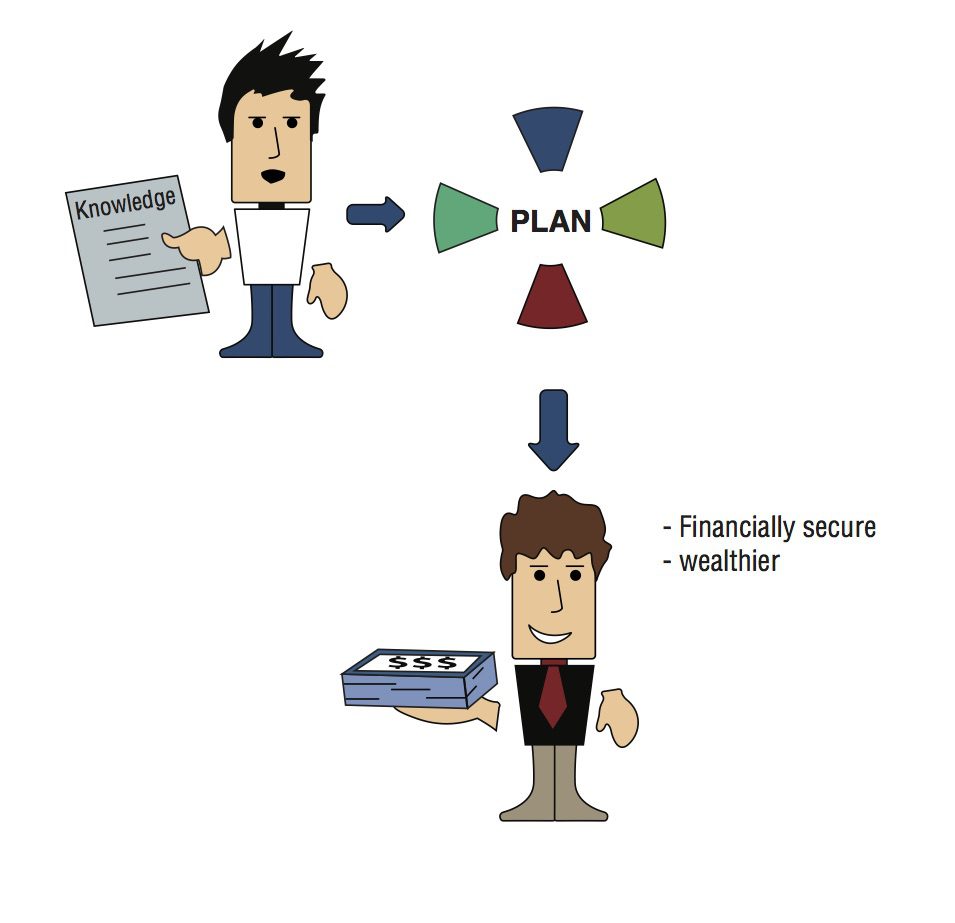

You need to gain all the knowledge you can on how to build your plans so you have a large base. You may not use all of the knowledge you have, but you cannot use knowledge you never gain. When you gain a strong knowledge base, it will help you to make your plans count.

Every effort you make toward crafting your plan needs to take pains to use everything at your disposal. Your experience has already taught you a lot of wisdom you may not have even considered before. When you gather more knowledge and work diligently on your plan, you can make some incredible changes.

2 Introduction to Home Finance

Make Your Life Better

A solid and well-crafted plan can do a lot for your life. You can become more financially secure and better able to weather hardships. You can become wealthier and enjoy the finer things in life. You can even maintain the same standard of living with a lower level of effort and be more comfortable. When you create a plan that works well, all of these options become more than mere dreams. They become both realistic possibilities and a series of goals you can strive toward and accomplish.

There are a lot of different ways to judge how financially successful you are, and no one else can decide how well you are doing. The best part of living in the modern world is that you have the opportunity to form a plan and make it work regardless of the specific details your plan may involve. No matter what your goals are, you have the chance to create the kind of life you want by taking a path that is well established and that you can track at every step.

You can become wealthy enough to have all of the pleasures the world can offer. If you would love to travel, to eat the fanciest meals money can buy and have shiny vehicles parked in your heated garage, you can make these things a reality. If you want to have enough money to take a year off of work and devote every day to your favorite hobby, you can do this. If you want to get to the point where you can make a reliable living working only three or four hours a day, even this could be possible when you take the time and put in the effort to plan.

Some Big Goals Must Be Planned

The old saying that Rome wasn’t built in a day is a vast understatement. While you might not be constructing massive stone buildings or creating an entire cultural tradition, you’ve got a lot to build in your life. There are a lot of big goals that require most people to do a lot of planning to accomplish. Going to college, buying a house and eventually retiring are undertakings that require a lot of planning for large cash outflows.

For most people, there is a lot of work associated with getting enough money together to pay for these goals. Considering that the cost of college tuition seems to rise far faster than other costs and the craziness in the housing market, a plan is definitely necessary to keep these goals in the realm of reality.

And while you can take out a lot of loans that may make financing a home and an education possible, getting a loan to retire on is a far less likely! For all of these large goals planning will benefit you regardless of your financial situation.

When it comes to the major goals in life, planning should start as far in advance as possible. If you find yourself falling short because of a poorly-built plan or a plan to “wing it,” your goals may be set back by years. In the case of home ownership, you may find yourself unable to afford the home you want or a neighborhood that feels good to you. In the case of retirement, failing to plan may be the same as planning to work years or even decades longer than you want to.

Preparing for Different Phases in Life

No matter what point in your life you find yourself at right now, there are some financial goals that apply to you. If you are in your teens or early 20s, completing your education is a very real and present goal. If you have been out of school for a few years, your work life and your intentions concerning your living situation are very reasonable things to be thinking about. If you are in your 40s or 50s, retirement is probably on your mind.

Life doesn’t have formal stages so much as priorities that shift slowly but constantly. When your children are first born, taking care of them is probably your most vital goal. When your kids are grown, building a sound retirement is definitely a priority. If you don’t form a plan, you won’t be able to get the most for your efforts. Without planning, you may miss the opportunity to acheive some of your goals.