Overview

Governments in most countries use three major tools to intervene in market trading:

- Imposing a purchase tax.

- Providing subsidies.

- Setting minimum and maximum prices for specific goods.

Purchase tax

A purchase tax is a tax imposed on a specific product. In general, countries impose purchse taxes on imported items and luxury goods. For example: The government imposes a $1 tax upon every package of cigarettes sold. The producer usually pays the tax, taking it into account in the same way as the cost of raw tabacco leaf. Purchase tax becomes part of production costs. A purchase tax shifts the supply curve to the left.

Explanation

For every quantity of goods produced, the marginal cost of each item increases by the amount of the tax. In other words, the cost of every product will increase by the amount of the tax. If the tax is $1 and the item costs $15 to produce, it will now cost $16.

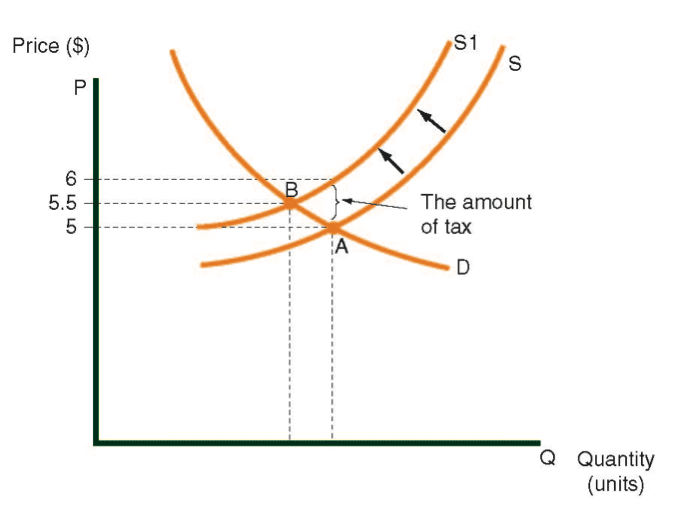

Supply Curve S as presented in the diagram shows supply before the tax, while Curve S shows the updated Supply Curve after the tax takes effect.

The leftwrd shift in the supply curve causes an increase in the market price. As can be seen in the following digrm, the price rises from $5 to $5.50. From this price, manufacturers must pay the government $1, while retaining $4.50, as compared with the $5 that could be retained before the tax was introduced. Consumers now pay $5.50, as compred with $5 before the tax. Manufacturers and consumers each absorb half of the purchase tax, i.e., the tax costs them each $0.50.

Supply curve before and after a purchase tax

Granting Subsidies to Procedures

In many countries, governments subsidize the production of bread and other agricultural products in an effort to lower the cost for the end consumers. A subsidy is a payment of money to a producer to support the manufacture of a product. A loaf of bread is one example. The effects of a subsidy resemble those of a discount on the price of flour or electricity i.e., the subsidy reduces the costs of production for a loaf of bread. The subsidy shifts he supply curve to the right.

Explanation:

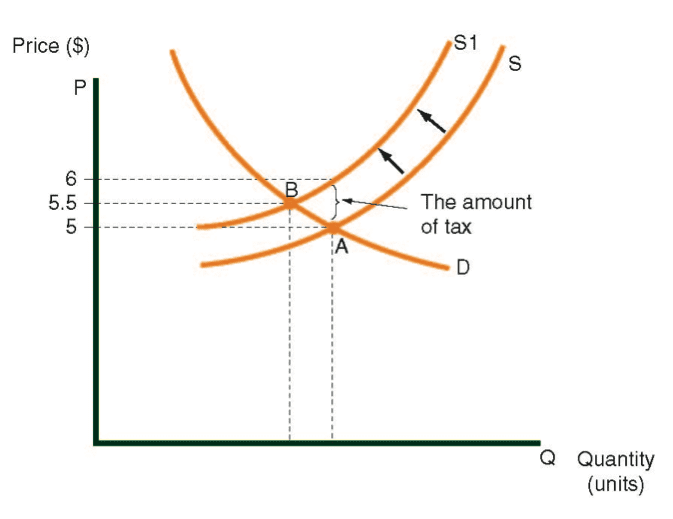

For any quantity produced, the margical costs relative to each item fall in tandem with the subsidy. The following diagram shows supply before the subsidy, while Curve S1 shows the updated supply curve after a subsidy of $2 per loaf has been granted.

The subsidy shifts the supply curve to the right, and lowers the price of bread from $5 to $4. Producers receive $6 per loaf of bread, the consumer pays $4 per loaf, and the government pays $2 per loaf.

Supply curve before and after a subsidy is granted

Setting a maximum price

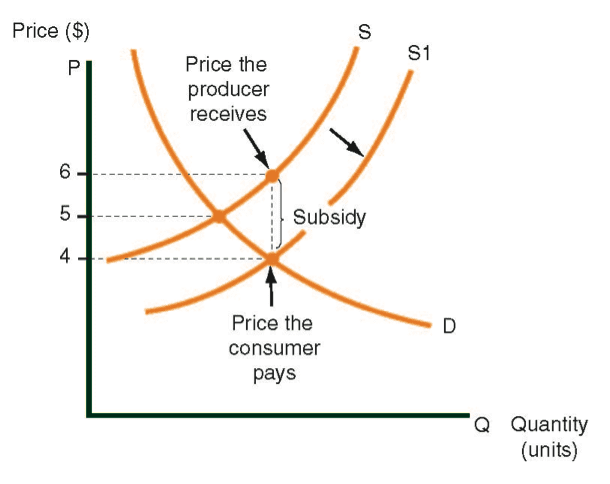

Some countries want to limit the prices of certain products, especially basic goods that are needed of survival. The supply and demand curves for milk are presented in the following diagram.

Supply and demand curves for milk

The market price of carton of milk is $5. At this price, demand will be 10 million cartons. Assume that the government decides that the maximum price for a carton of milk should be $4. At this price, the demand will reach 12 million cartoons, and the supply will be only 8 million cartons, leving a shortage of 4 million cartons.

The government can cover this gap by either:

- Selling milk from the country’s emergency reserves at $4 a carton.

- Buying milk from another country, and selling it for $4 a carton.

- Setting a policy of budgeting and dividing the groceries with food coupons payments or by any other method.

As mentioned above, the government can also using subsidies for dairy farmers to reduce the price of milk. Deciding whether to use subsidies or set a maximum price depends on many factors beyond the scope of our discussion.

Setting a minimum price

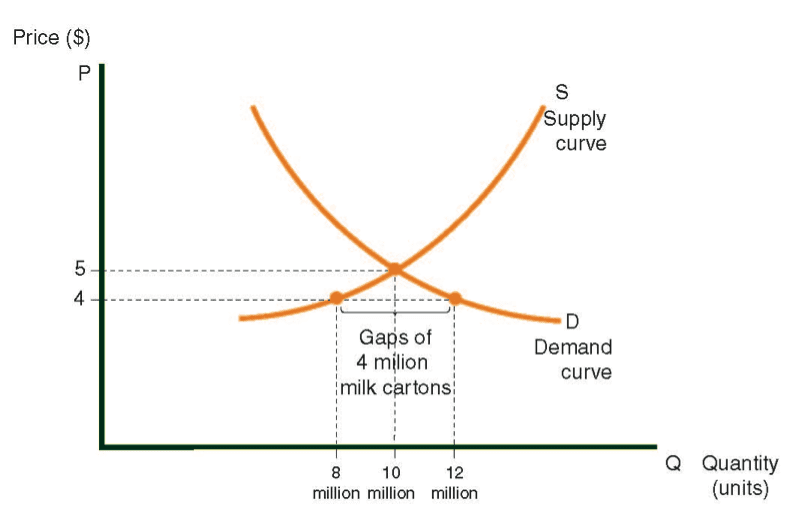

Governments usually set a minimum price when the supply curve is totally inelastic. One example of a totally inelastic supply curve is agricultural produce, which has a very short shelf life since it often spoils within a week. This means that a farmer must sell his produce at any price in order to avoid being stuck with spoiled merchandise. The supply and demand curvesfor flowers are represents in the following diagram.

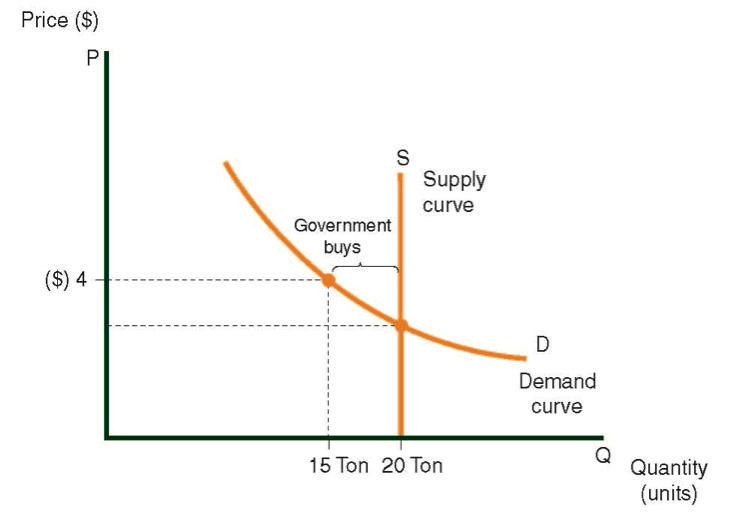

In order to assure a minimum profit for flower farmers, the government intervenes in the flower market and sets a minimum price of $4 per kilogram. At this price, consumer want to buy 15 tons, while farmers want to sell 20 tons. The government purchases the 5 tons of surplus flowers.

Supply and demand curves for flowers

Limiting Production

- In the agriculture sector, overproduction (growing too much of a certain item) can lead to a drop in price and cause farmers to lose money. The government intervenes at the planning level and limits the amount of product by setting farming quotas. For exmple, Country A limits the amount of eggs that can be sold. Farmers who raise more chickens, than their quota

- May face fines and other penalties.