The balance sheet presents a picture of the company’s situation on the final day of the reporting period (usually December 31, the last day of the year). The balance sheet lists the company’s property on one side and its debts on the other. In accounting, property is called “assets,” and debts are called “liabilities.”

A balance sheet is usually prepared after the income statement and the statement of capital are prepared, since the information from these two statements is used in the preparation of the balance sheet. For example, the balance of the capital account—as calculated in the statement of capital—is the first line of the balance sheet. Although the heading of the balance sheet is the same as that of the other two financial statements—in the sense that it conveys the owners name and the name of the financial—it does differ in one important respect: Instead of covering a period of time, the balance sheet provides a snapshot of the state of a company at the specified date. This is different from the statement of cash flows and the income statement, which cover periods of time.

Key Features

The balance sheet of a firm shows its financial position. It provides detailed information regarding the assets and liabilities of the firm. The balance sheet is divided into two columns, one containing the liabilities of the firm and the other containing the assets. Upon completion, the two columns must balance, since it is a “balance sheet.” That means that at any given point in time, the liabilities of a firm must be equal to the firm’s assets.

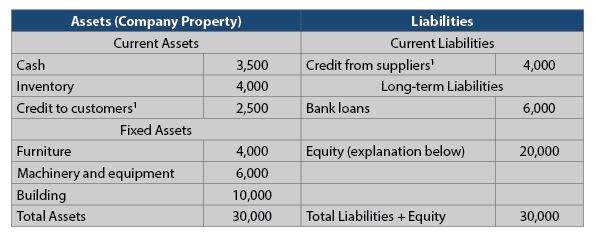

As can be seen in the following example, the balance sheet is in the form of a table with two columns: a left column and a right column. The left column lists all of the company’s assets, while the right column lists all of its liabilities. The following balance sheet relates to Chess Pizza Company, which operates a neighborhood pizza parlor.

The assets item lists the company’s assets as of the balance sheet date.

Chess Pizza Company has assets totaling $30,000.

Cash—The amount of money that the company has in its treasury and its current account is $3,500.

Inventory—As stated in the preceding chapter, inventory is composed of several categories:

- Inventory of Raw Materials—Materials for making pizza, such as flour, tomatoes and cheese.

- Inventory in Production—Pizzas in the preparatory stages.

- Inventory of Finished Products—Pizzas ready for sale.

Chess Pizza had inventory worth $4,000 as of the balance sheet date.

Credit to Customers—This item is abbreviated as “Customers.” The sum is the amount of money that customers still owe to the company for pizza purchases. Chess Pizza has regular customers who pay two months after receiving pizzas. As of the balance sheet date, customers owed the company a total of $2,500 for pizzas that they purchased.

Furniture—This item includes tables, chairs, a wooden counter, etc. The total value of the company’s furniture was $4,000 as of the balance sheet date.

Machinery and Equipment—This item includes ovens, pizza-cutting machines, kitchen utensils, a cash register, a computer, etc. worth a total of $6,000 as of the balance sheet date.

Building—The company owns the building in which the pizza parlor is located. The building is worth $10,000.

Chess Pizza Company Balance Sheet Example

The Value of Assets in the Balance Sheet

Liabilities

When a company buys an asset (for example, land, a building or machinery), it lists that asset in the balance sheet at its purchase price. Over the years, the market value of the asset may increase or decrease, but this will not be reflected in the balance sheet. The building owned by Chess Pizza is currently worth $100,000 (as estimated by an assessor), but it is listed on the balance sheet at its purchase price of only $10,000. The value of assets in the balance sheet should therefore be used with caution, because it does not always reflect their real value. In many cases, the value of fixed assets in the balance sheet differs from their market value.

The liabilities item lists the company’s debts as of the balance sheet date.

Credit from suppliers (debts to suppliers):

This section is abbreviated as “suppliers”. It lists the sums that the company still owes to its suppliers for the merchandise that it purchased. In the business world, companies do not pay immediately for the merchandise that they buy; they pay at a later date (after one or two months, or even longer).

Chess Pizza still owed its suppliers $4,000 as of the balance sheet date.

Bank loans—This item lists the outstanding balance of the loans that the company owes to banks ($6,000).

Equity

When a company’s total assets are greater than its liabilities (which is usually the case), the difference between them is called “equity,” which is listed in the right column of the balance sheet, under the liabilities items. Listing the equity in the right column makes the total of the right column in the balance sheet equal the total in the left column. That is why this statement is called a balance sheet: The totals of the two columns “balance” (i.e. are equal).

In the previous example, the assets total $30,000, and the liabilities (to suppliers and banks) total $10,000. The equity is equal to the difference between them ($20,000). In order to avoid confusion in this explanation, the heading of the right column in the balance sheet was listed as “Liabilities”, but its full name should actually be “Liabilities + Equity”.