The Time Value of Money and Your Personal Finance

The Time Value of Money

The time value of money (TVM) is a vital concept in finance. TVM can be used to compare investment alternatives and solve problems like annuities, savings, leases, mortgages, and loans.

The reason why you have more money today is that you can invest it somewhere and earn interest. It means that money today is worth much more than a dollar in future.

The reason for this is that when you receive a dollar today, you can invest it in many ways to give you more than the dollar, you expect to have in future.

Therefore, a dollar today is worth much more than the same dollar tomorrow.

Understanding the time value of money is necessary since it helps you to understand financial problems in investments, personal finance, insurance and even banking.

The Importance and Effects

If you are new to the finance world and you haven’t come across this concept, then you have come to the right place. Read on and find out more about the importance and how the time value affects your personal finance.

Time value of money is essential for investors since it enables them to identify the appropriate investment. A dollar that you have been promised in future is worthless because of inflation. Therefore, it is better to invest the dollar today and reap the rewards in future.

The 5 Variables

There are five variables of the time value of money. They include:

- The present value (PV),

- Interest rates (i),

- Future value (FV),

- Payment amount (PMT)

- The number of periods (N).

You should identify the variable that you have and the one you need to calculate.

Present Value

It refers to the amount today which will equivalent to a future payment and has been discounted using a suitable interest rate.

Future Value

The value is the amount of money that an investment that has a fixed interest rate will grow at a next date.

Interest rates

The interest rate is the money that you pay back when you borrow funds. It is always a percentage of what you have borrowed at a given time.

The Importance of time value of money

As we have previously stated, TVM is crucial to investors in the financial markets since it helps them make the right investment decisions based on facts rather than guessing. The calculations come in handy in calculating personal finance, economics, and investments.

Time value of money formula

When it comes to the equation, there are two ways to calculate the time value of money. The future value formula and present value formula are as indicated below.

FV = PV (1 + r) ^n

PV = FV / (1 +r) ^n

From the above formula; the PV is the present value at time 0

FV is the future value at time n

R is the interest rate

N is the number of periods

Let’s take a look at an example:

Example 1:

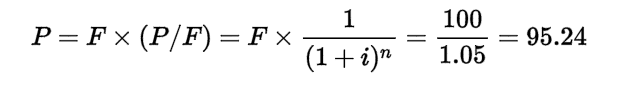

Present value One hundred euros to be paid 1 year from now, where the expected rate of return is 5% per year, is worth in today’s money:

So the present value of €100 one year from now at 5% is €95.24.

Attribution: Wikipedia Time Value of Money

Defaulting and Inflation

Money that is expected in future is like lending the money. Thus, it will be affected by many factors such as defaulting and inflation. The rate of default will increase when the borrower does not pay back the money as promised.

For instance, if you lend your friend $1000 today, and he promises to pay back the money in a year. The problem comes in when your friend does not pay back the money as previously agreed. Moreover, the funds will also be affected by inflation. It will not be possible to spend a lot of your money as you would have one year ago.

Money loses value due to inflation which means that your purchasing power will reduce. The opportunity cost of having the money now includes the loss of income that you could have got in the future. The value of money decreases each passing day.

There are many areas where time value of money is applied. For instance, it can be used to compare the cash flows of different investments and choose the one that will have high returns. It also helps an investor to know the amount of money to needed for a given investment.

The TVM can also be used to explain why interest is earned or paid. The interest acts as compensation for the lender.

There is more than meets the eye when it comes to the time value of money, but the above is just some of the basics that you should know about. If you did not have any idea, now you are informed. As long as you are handling money, you need to know about the time value of money.

Tips and Info

If you are looking to educate yourself in the financial world than you should undoubtedly read some of our very informative articles that will give you some basic information. Read these two great articles on the: