In addition to the ordinary benefits, some bonds confer the right to convert them to stock in the company.

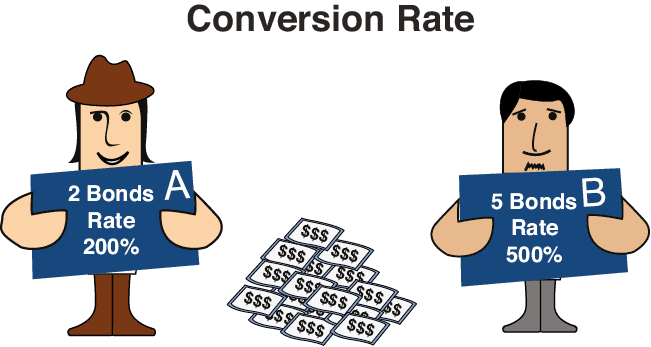

Conversion Rate

When a company issues convertible bonds, every company determines how many convertible bonds are required in order to receive one share of stock.

Firm A decides that two convertible bonds can be converted for one share. Firm B decides that five bonds are needed to receive one share.

The conversion rate for Firm A is 2, or 200%, while that of Firm B is 5, or 500%.

If a company conducts a stock split, the conversion rate must be adjusted so that bondholders receive stocks of equivalent value.

For example, if the conversion rate is 200% and the stock split is 3-for-1, then the new conversion rate must be set so that investors receive three shares for every two bonds. The new rate is 67%, or 2:3, instead of the previous 2:1, because each stock prior to the split equals three stocks after the split.

Exchange Stock

When a company has more than one class of stock, then the bond specifies what type of stock it can be exchanged for.

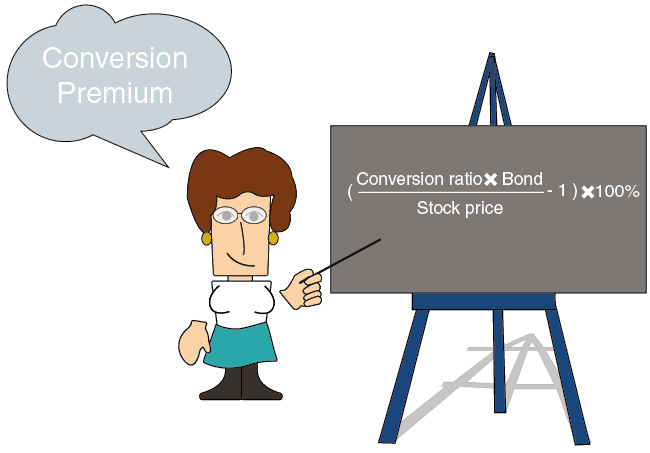

Conversion Premium

The immediate conversion premium represents more or less the same amount that an investor would pay if he were to buy bonds and convert them to stocks as opposed to buying the stocks directly.

Use the following formula to calculate the conversion premium:

![]()

If investors must pay more, then there is a conversion premium. If investors pay less, then a discount will be offered.

For example: assume the price of the convertible bond is $1.10, then the stock price is $2 and the conversion ratio is 200%. The conversion premium is 10%.

![]()

Profitability of Convertible Bond Purchases

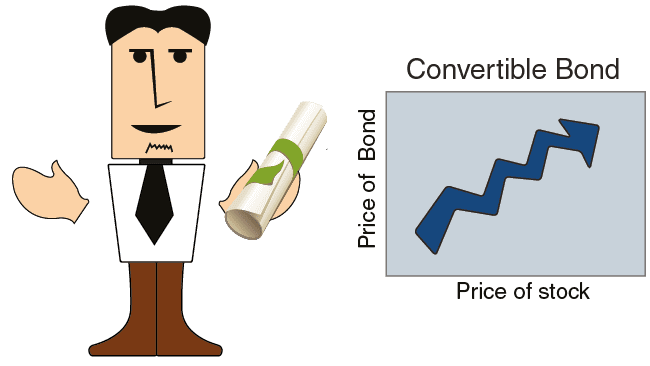

In addition to the interest rate paid by the company, convertible bonds provide another advantage to their holders. The price of ordinary bonds is independent of the stock price of the company that issued them, but the price of convertible bonds rises when the stock rises.

ExampleAssume that Company A’s stock price is $2. If its convertible bonds are sold for $1 and the conversion rate is 200%, then there is no conversion premium. In other words, an investor pays the same amount of money whether he buys the company’s shares directly or buys convertible bonds and exchanges them for shares.

If the stock price rises 20% to $2.40, bondholders will not sell them for less than $1.20 because they can trade their bonds at any time for stock worth $2.40. In this case, the price of the bond will also rise 20% to $1.20.

In general, it can be said that convertible bonds offer investors two advantages:

-

They have a floor value: Every bond guarantees its holder both principal and interest. Stock prices, on the other hand, can decline sharply with no guarantee of either principal or interest.

-

The price of the bonds will rise if the company’s stock price rises. These advantages can also represent drawbacks. For instance, convertible bonds usually have lower yields than ordinary bonds.

These advantages have drawbacks. Convertible bonds usually have lower yields than ordinary bonds.