David’s options were gifts from his parents. However, they did not forbid him from giving or selling the options to other people. As will be seen on the following pages, the value of the options rise and fall every day according to the fluctuations in the price of gold.

Earning a Profit on the Expiration Date of Options

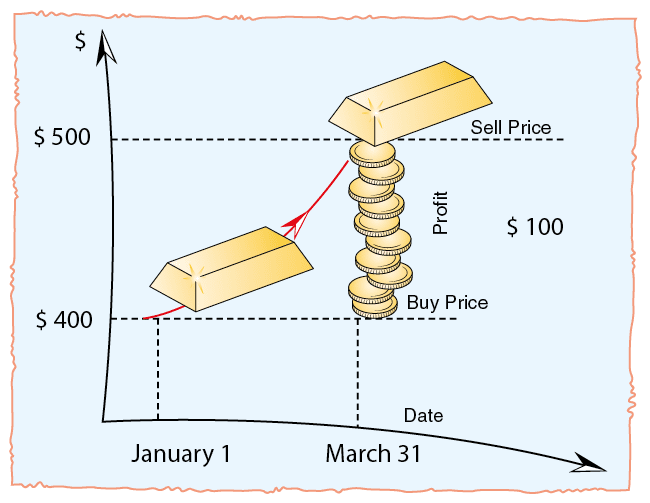

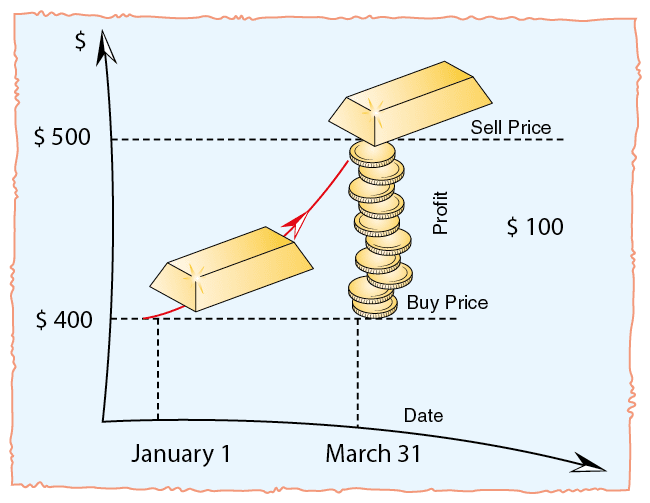

In the previous example, we explained that David can exercise his call option if the price of gold reaches $500 an ounce on the expiration date. He can buy an ounce of gold from his father for $400, and sell on the market at a $100 profit. Making money this way is complicated and time-consuming.

For this reason, the stock exchange is organized to save David the trouble of expending pointless energy. All he has to do is bring the option to the market and the market will pay him his profit. Option writers can also make money by selling their options initially, as shown below. In this case, David earned $100 and his father lost the same amount. The same sequence of events can occur with the put option that David’s mother gave him. If the price of gold falls to $350 an ounce, then David presents his put option and receives $50. The market then presents the option to his mother and receives $50 from her.

David gains $50 and his mother loses the same sum.