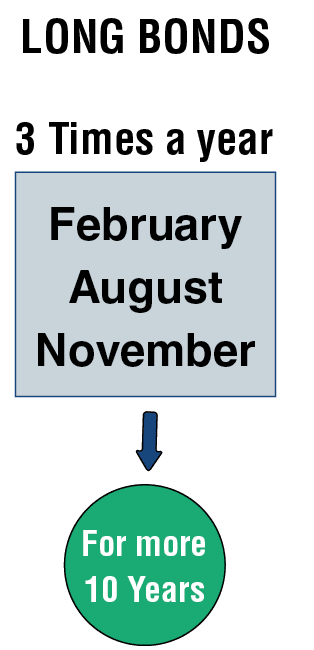

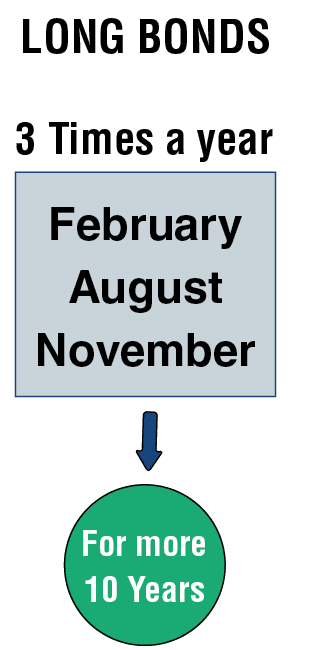

Treasury bonds are issued for periods of more than 10 years until maturity, and they are also called long bonds. They usually bear higher interest than the government bonds with shorter maturities.

Until 2001, the U.S Government issued bonds for periods of up to 30 years. Since then, however, the Treasury retired the 30-year bond only to later reintroduce it in later years based on investor demand. Though U.S. Government issues them, Treasuries are still financial products subject to investor demand. Their details are adjusted to meet the needs of investors.

The Treasury Bonds and Treasury Notes Tables on the “Wall Street Journal” Website

The prices for all Treasury Bonds and Notes are presented on “The Wall Street Journal” website within a single table. All of these bonds and notes share similar characteristics, which are listed in the table..

The table for T-bills has already been displayed and is situated below the bonds and notes table

Explanation of the Bonds and Notes table:

- Column 1– Maturity – the maturity date of the new bond listed as DD/MM/YYYY.

- Column 2 – Coupon – the coupon that the bond pays.

- Columns 3-4 – Bid and Ask – the prices asked of and bid for the Treasuries.

- Column 5 – Chg – the change in the bond price since the prior trading day.

- Column 6 – Asked Yield – the yield to maturity, which is based on the demand price of the bond.