What are Profit and Loss Statement Ratios?

USA Furniture’s Profit and Loss Statment for 2007 ( in $)

| Sales | 100,000 |

| cost of sales | 80,000 |

| Gross profit | 20,000 |

| Sales, mamagment and genral expenditures | 5,000 |

| Operating profit | 15,000 |

| Financial expenditures | 2,000 |

| Pre- tax profit | 13,000 |

| Income tax | 3,000 |

| Net profit | 10,000 |

The following three popular rations are called “profit ratios” :

| For USA Furniture: | ||

| Gross profit to sales ratio | Gross Profit/ Sales | $ 20,000/ $100,000= 0.2 |

| Operating profit to sales ratio | Operating Profit/ sales | $ 15,000/ $ 100,000= 0.15 |

| Net profit to sales ratio | Net Profit/ Sales | $ 10,000/ $ 100,000= 0.1 |

Purpose of the ratios:

The profit ratios are designed to evaluate the company’s capability to generate profit on its sales.

Significance of the ratios:

These ratios indicate every USD of sales generated for USA Furniture:

-

$ 0.20 in gross profit.

-

$ 0.15 in operating profit.

-

$ 0.10 in net profit.

Interpretation of the result:

Profit ratios vary between different sectors. In general, however, it can be stated that when these ratios are higher, the company derives more profit from its sales.

The usual profit ratios in industrial sectors are as follows:

-

Gross profit ratio – 20% to 40%.

-

Operating profit ratio – 5% to 10%.

-

Net profit ratio – 2% to 5%.

It is important to note that when a company experiences losses instead of profit (net loss, operating loss, or even a gross loss), its profit ratios are negative, i.e. it loses money.

The worst situation is when the gross profit-sales ratio is negative. Such a ratio means that total sales are lower than the direct expenditures involved in production, even before indirect expenditures are taken into account. In most cases, a negative gross profit-sales ratio should serve as a warning about the company’s performance.

Net Profit Per Share

Ratio Data:

|

For USA Furniture (1,000 shares were issued ): |

|

|

Net Profit Per Share Ratio= Net Profit/ Total shares issued by the company |

$10,000/ $ 1,000 =$ 10 |

Purpose of the ratio:

This ratio evaluates the profit generated for each share held by the owners. In some financial statements (particularly stock exchange-listed companies), the net profit per share ratio appears in the bottom line of the “Summary profit and loss statement”. There is no need to calculate the ratio.

Significance of the ratio:

The net profit per share ratio helps investors decide about buying and selling a share.

Example:

Two companies in the same sector (Company A and Company B) each earned $10,000 in net profit during the year. Company A has issued 1,000 shares and Company B has issued 5,000 shares.

Company A’s net profit per share is $10 ($10,000 divided by 1,000 shares).

Company B’s net profit per share is $2 ($10,000 divided by 5,000 shares).

If both company’s shares were listed on the stock exchange for $200, investors would be far more likely to buy Company A’s shares. No one would buy Company B’s shares, since they could obtain a higher profit from Company A’s shares at the same price.

Note:

In this context, the existence of a popular measure called the “price-earnings ratio” should be noted. This measure is designed to analyze the viability of buying any given share.

Price-earnings ratio

The price-earnings ratio is obtained by dividing the following two figures:

| In the Above Example (Company A) | |

|

Price – earning Ratio= Share price/ Net profit per share |

$200/ $ 10 = 20 |

The price-earnings ratio (or, in short, the multiple) calculates how many years are theoretically needed to earn back an investment in a share (the price paid for the share), assuming that the annual profit does not change in the future. The assumption that the net profit will not change in the future is unrealistic for quite a few companies.

For example, companies like Microsoft and Intel are growing at stunning rates every year and it is unreasonable to assume that their profits will suddenly stop growing.

For companies in which it is reasonable to assume that future profits will remain constant or will vary only slightly in either direction, it has been found that the price-earnings ratio ranges between 6 and 12, i.e. the investor will earn a return on his investment in the share within 6-12 years.

On the other hand, it has been found that the price-earnings ratios of rapidly growing companies can reach 20, 30, and even 100. The reason that investors are willing to pay for the share at such high multiples is highlighted in the next example, which involves a growing company whose annual profit is expected to grow by 30% per year.

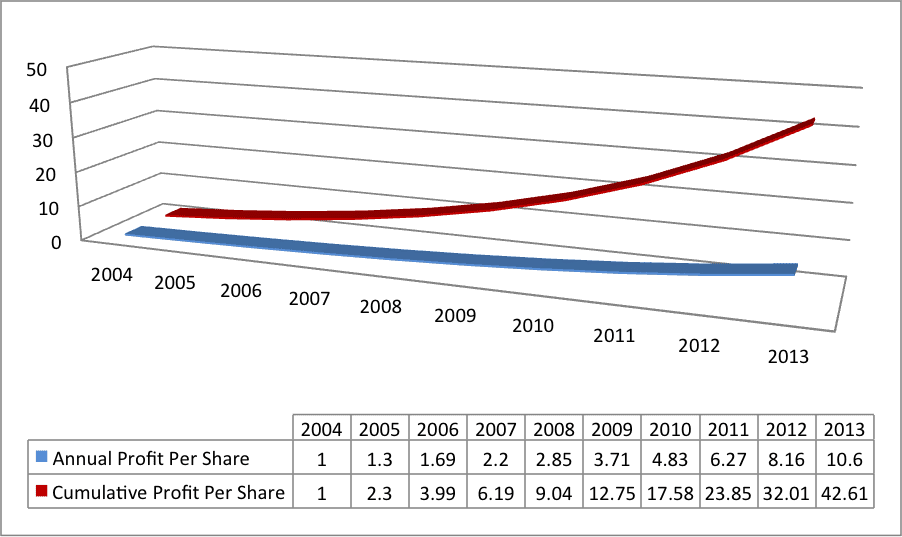

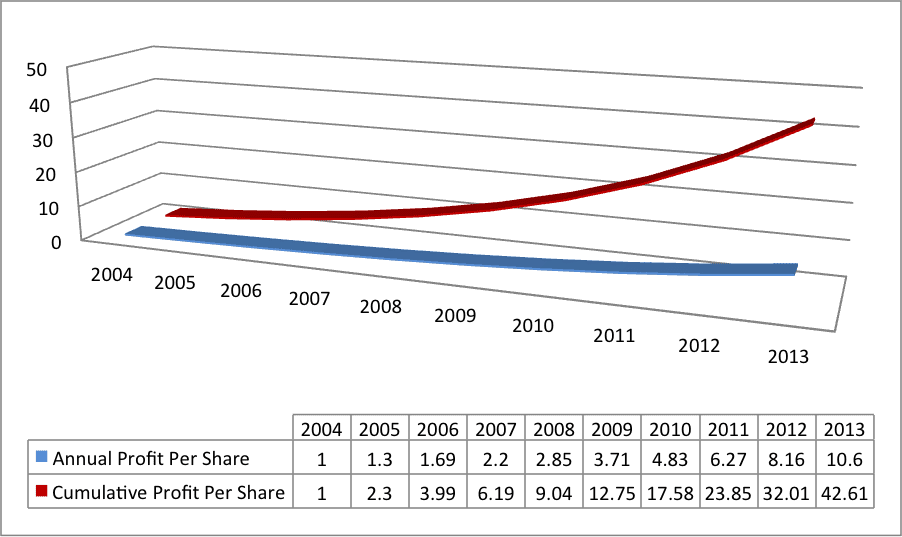

The profit figures for the company are displayed in the following table:

Share price – $42.

The multiple – 42 ($42/$1)

The previous graph shows that if the profit grows by 30% per year, an investor who purchases the share in 2004 for $42 will accumulate $42.61 in profit over 10 years, meaning that he will earn back his investment within 10 years.

When an investor bought the share, the price-earnings ratio was 42, but the profit did not remain constant. It therefore did not take the investor 42 years to earn back his investment.

If the company stops growing in 2013, meaning that its profit remains constant during subsequent years and the price-earnings ratio for similar companies is 10, the share price in 2013 should be $106.0

($10.60 x 10). In other words, the share price ($106.0) divided by the annual profit ($10.6) gives the multiple (10).

The price-earnings ratio can also be calculated using the following method:

|

Price – earning Ratio = Market value of the company/ Total net profit |

The market value of a company is obtained by multiplying its share price by the total number of shares issued.